Branded Search

What customers feel when they think of your brand name is critical to the flourishing of your business. And as more customers start their product searches on Amazon, what shows up in the Amazon search results is critical.

What is branded search?

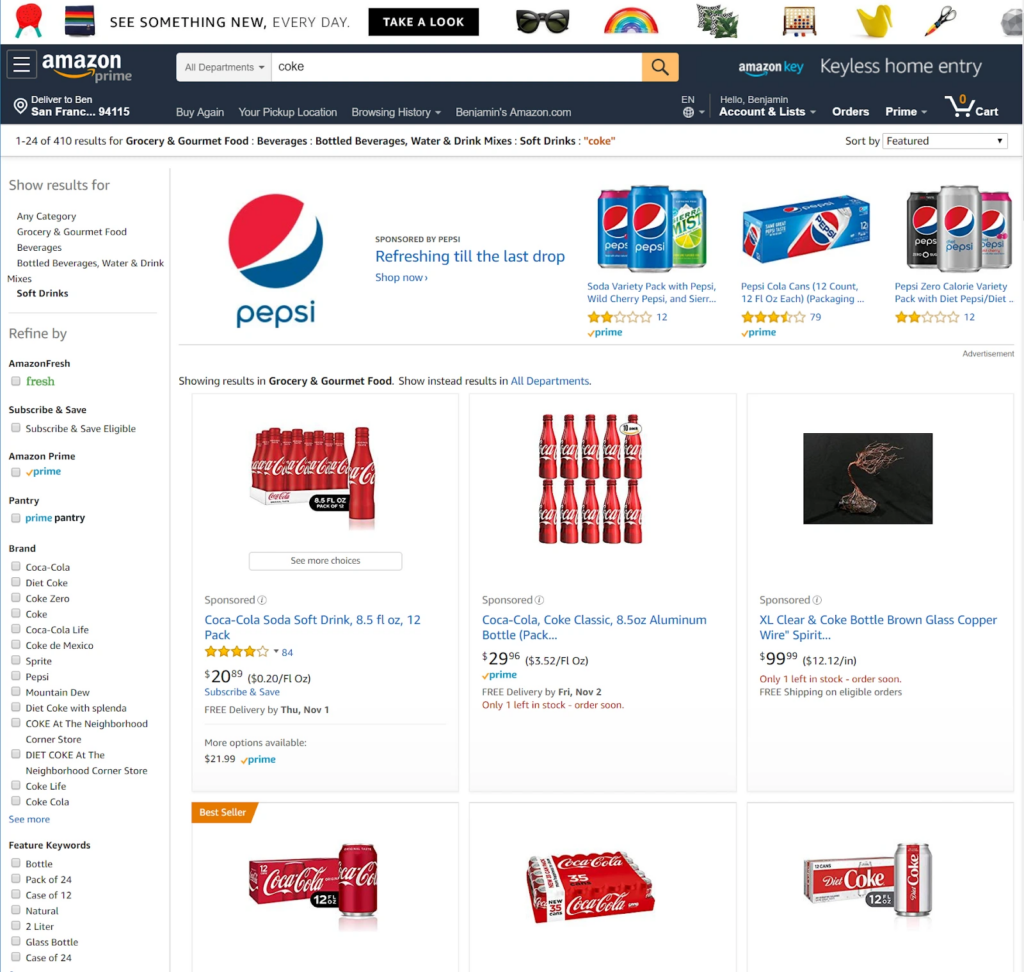

What a customer types into the search bar when they begin looking for a product on Amazon is called a search term. These can be branded or non branded. For example, a non-branded search term might be “tissues” or “soda” and a branded search term would be “kleenex” or “coke”.

Why is branded search important?

If your customer searches on your brand name, what do you want them to see? Your products!

Take a look at this search where “coke” yields a top of page Sponsored Brands placement for Pepsi products. This will reflect on the customer’s image of the brand and may even lead to sales for Pepsi when the customer went in with the intention of looking for Coca Cola products. (It’s an important example, though, as it shows that you may want to consider more than just your brand name in branded search!)

Merkle’s Q3 Digital Marketing Report reports that “Brand keywords accounted for 62% of Sponsored Brands sales and 42% of Sponsored Products sales”. Clearly it is critical for a brand to control their branded search placement on Amazon!

Branded search terms can fall into two categories: defensive spending if they are your own brand, and competitive spending if you are bidding on your competitors brand name.

Defensive spending generally yields an extremely low ACOS as customers are likely to convert if they are directly searching on the brand for which they see the ad.

Competitive spending can be extremely high ACOS, but important nevertheless as each conversion is a customer acquired from your competitor.If you make them happy with this purchase they may turn into repeat customers. Large brands tend to spend aggressively here as over time, competitive spending can have a sizable impact on your customer base.

Because branded spending can have extreme ACOS performance differences, it’s worth splitting these two out.

The pitfalls of mixing branded and non-branded search

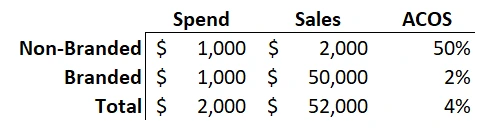

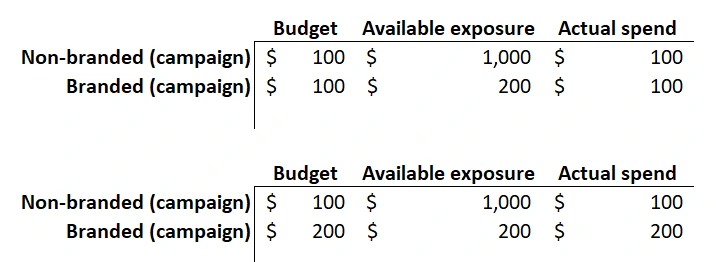

Let’s look at an example. Here you’ve spent $1,000 on both branded and non branded search terms. The non branded search performed at 50% ACOS, resulting in $2,000 in sales. The branded search resulted in $50,000 in sales and a 2% ACOS. If you have both mixed in one campaign you may look at the campaign and think “Wow, I’m super happy with 4% ACOS! I should increase my bids so I can get more impressions!”

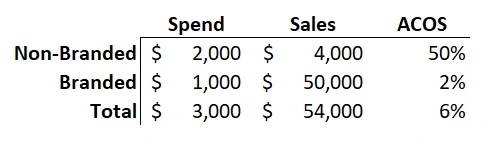

Generally what happens in this case is that you’re already maxing out your branded search potential so incremental spend goes to non-branded search and the performance ends up like this.

Your additional $1,000 in spending only drove an additional $2,000 in sales because it only expanded your non-branded reach. Probably not what you hoped for.

Budget management benefits to breaking out branded search

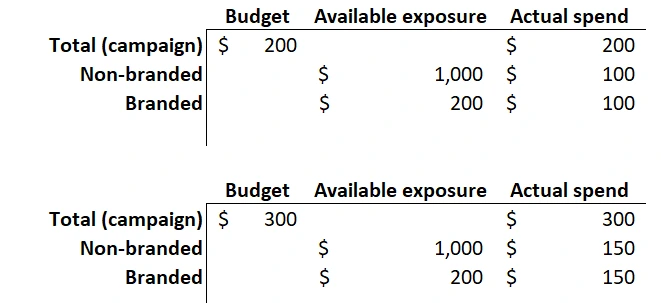

There is a flipside, too, and another reason to split out your branded search terms. Perhaps you’re running on a tight budget and your campaigns hit that budget by mid day. It’s likely that a significant amount of that budget is going to non-branded terms and leaves you without branded search coverage for the second half of the day. But to simply ensure branded coverage for the whole day you’ll need to increase your budget by enough to ensure non-branded coverage for the whole day as well! And that can be expensive!

In this example, you are spending $200 a day on a campaign that contains both your branded search (which if you had an unlimited budget you could spend $200/day on) and non-branded search (which if you had an unlimited budget you could spend $1000/day on). You’re running out mid-day and want to make sure you have your brand covered all day so you increase the budget to $300. The budget ends up split between the both branded and non-branded and you still runout before the end of the day, even though if you could direct that additional $100 to only the branded search it would have been enough to ensure coverage.

If you have them broken out at the campaign level it’s trivial to allocate that spend directly to the branded search without needing to increase your spend on non-branded terms. For Seller Central advertisers: note that you cannot control budgets at the ad group level so splitting branded terms up at the ad group level is not effective.

ACOS clarity benefits

The goal of all of this is to be able to understand and control the different kinds of exposure your products are getting. In the example at the beginning of this article, it looked like your campaign was performing at 4% where a more accurate view was that one part was at 2% and one part was at 50%.

Breaking out branded search into its own campaigns is the only way to easily analyse the situation in a way that leads to directly actionable insights like ACOS target adjustments and budget adjustments.

How do you do this?

Breaking out branded search is easy. The basic setup looks like this

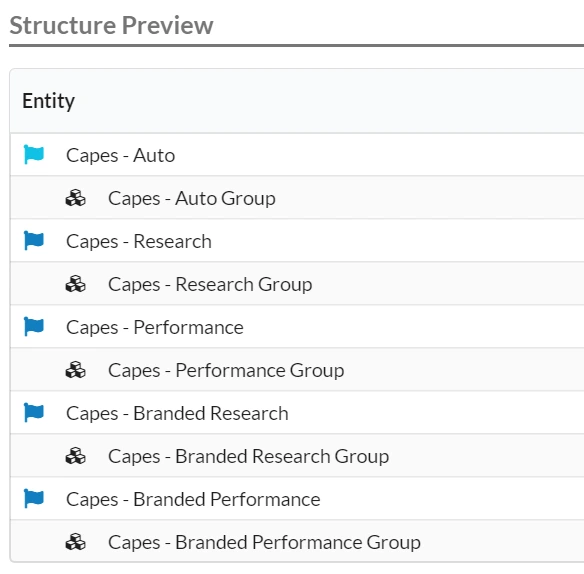

There are three generic campaigns:

- Auto

- Neg phrase brand names

- Research

- Neg phrase brand names

- Performance

- Neg phrase brand names

And two branded campaigns

- Branded Research

- Broad brand names

- Branded Performance

This directs all branded search to the branded research campaign and none of the branded search will show up in the generic campaigns. As brand terms make sales, you should move them into the performance campaign to control exposure with bid.

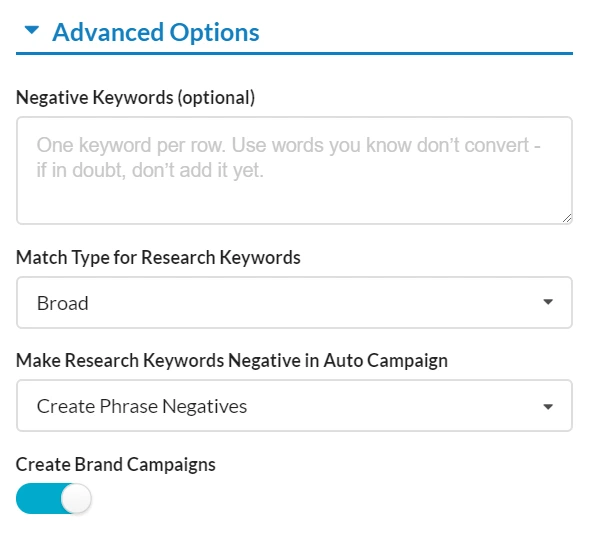

At Prestozon, we make this all super easy with 1 Click Setup. Just turn on “Create Brand Campaigns” in Advanced Options and then add your brand names to the “Brand Names” field. The correct campaigns, keywords, negative keywords, and keyword rules will be created. It doesn’t get easier than that!

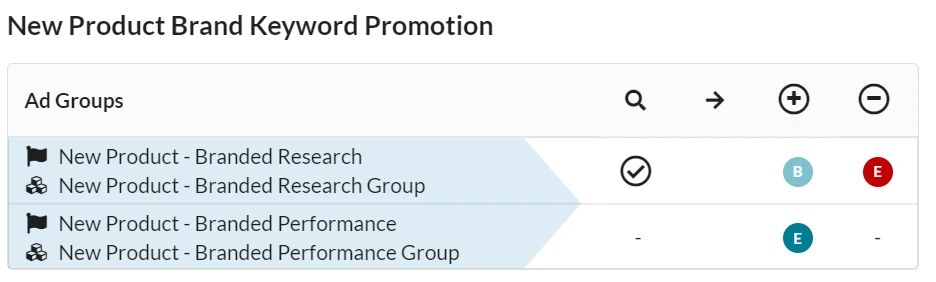

The rules that get created by 1-Click Setup with branded settings will then look like this:

Beyond branded search

Branded search is the most common and most obvious type of search to break out in this way. But you can also apply this to any group of search terms that are related and have drastically different ACOS performance than the average for a product group. For example, competitor brand names, or specific words that are either far up the purchase intent funnel or those right at the bottom are good targets. Defining these groups, and whether or not they exist, is a product-specific question.

As always, Prestozon is here to enable easy keyword and search term management no matter what kinds of search terms you need to manage.

Photo by Alex Block on Unsplash

Original post from Splitting Out Branded Search – Helium 10