Most of the year Amazon advertising performance is fairly stable for most accounts. There are a few days that stand out, like Prime Day, but nothing compares to the wild ride of November and December.

Most of the year Amazon advertising performance is fairly stable for most accounts. There are a few days that stand out, like Prime Day, but nothing compares to the wild ride of November and December.

We took a look at the average performance during this period so account managers can have some context. This is especially useful if you don’t have last year’s data for your account readily available. If you’re a long time prestozon customer, we encourage you to take a look at last year’s data when you’re preparing for this Q4!

Let’s start by looking at some metrics independently. Most of these are normalized to a baseline period. What that means is that we took each account’s average value over the four week period October 4-November 1 and compared every day for that account to that value. That makes it possible to compare different sized accounts without the largest accounts dominating. It also allows us to compare accounts that are in different niches, such as if one is running a $0.50 average CPC and one is running $5.00 average CPC.

All data presented is anonymized and aggregated among several thousand accounts.

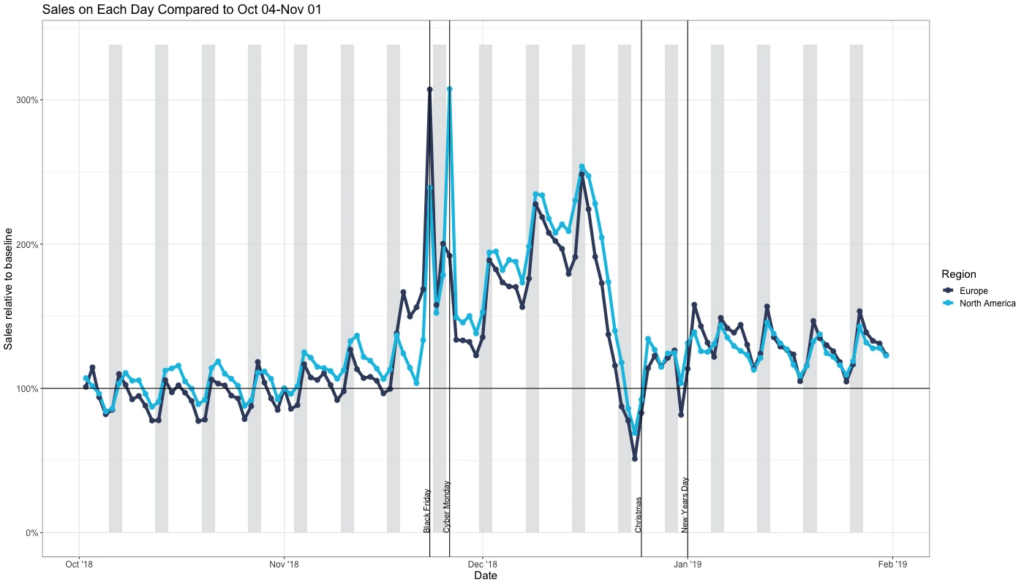

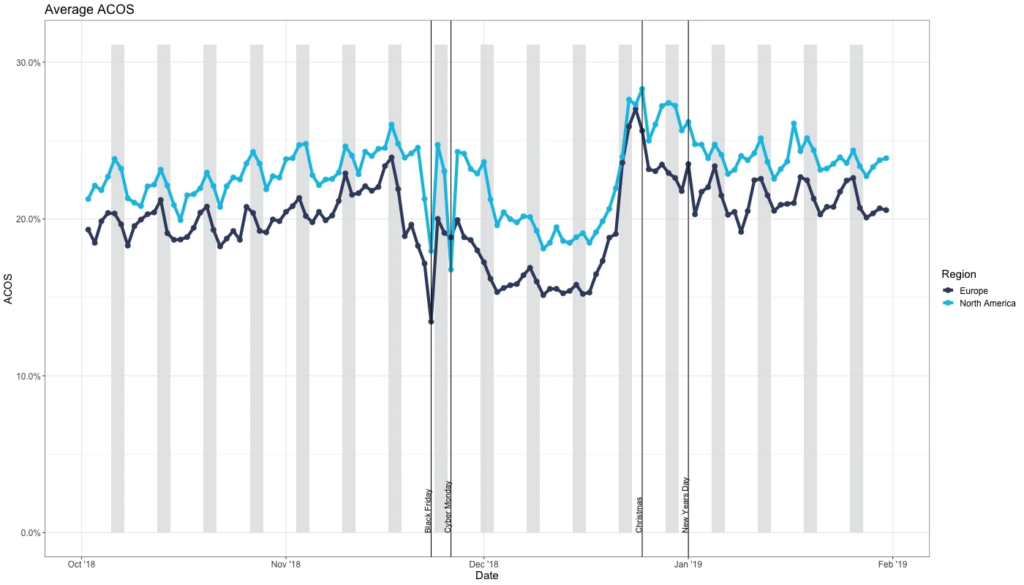

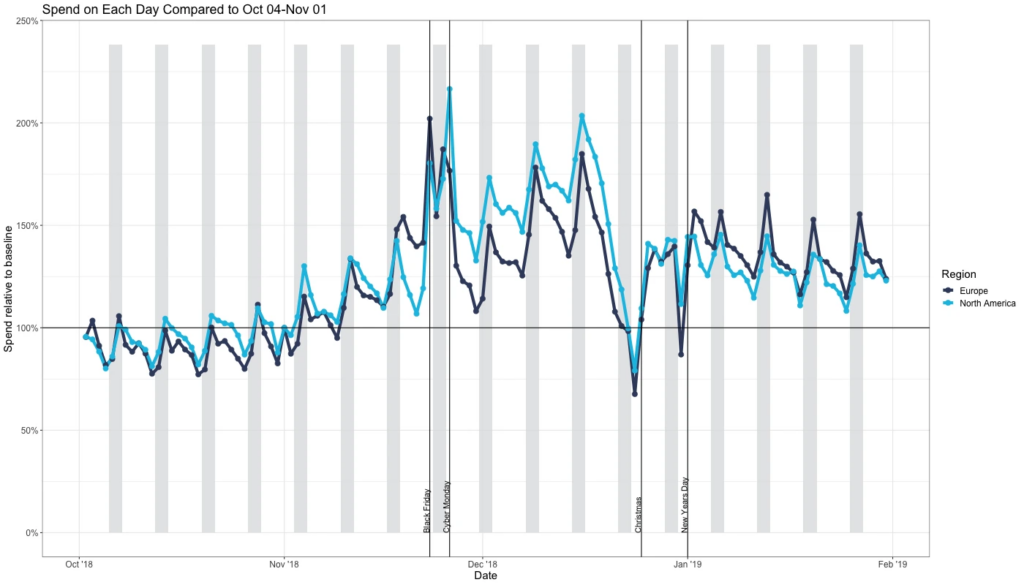

The two primary metrics everyone is interested in during the holiday season are sales an ACoS. These plots show the average shift for the accounts in the analysis, split between Europe and North America.

- Sales is fairly stable until early November when it starts picking up.

- There’s a short lead up to Black Friday and Cyber Monday (BFCM) with Black Friday performing stronger in Europe and Cyber Monday performing stronger in North America.

- The weeks after BFCM until last ship date continue to show growing sales, peaking about a week before Christmas at 250% of October’s sales.

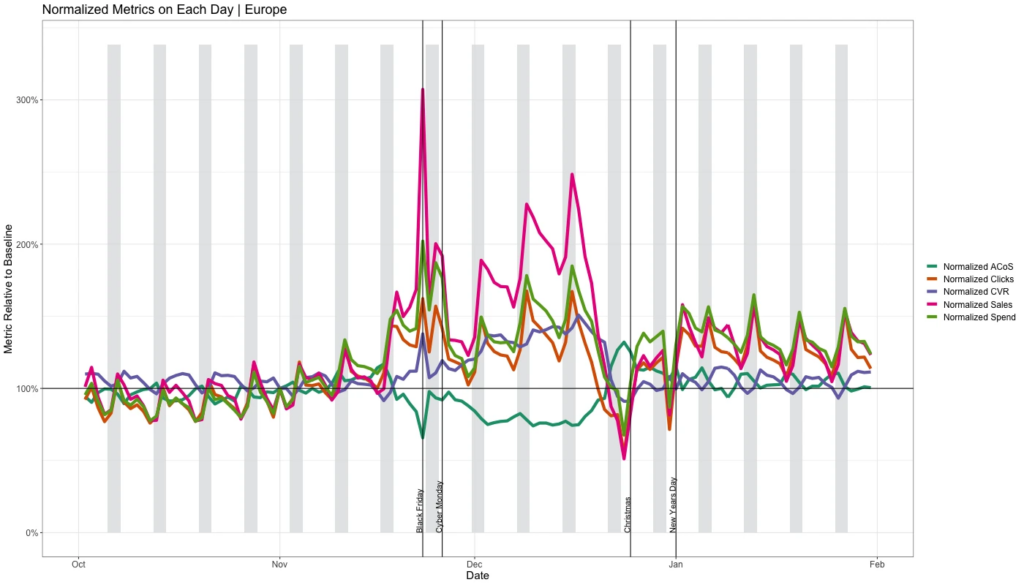

- ACoS shows a slight lift right before BFCM. This is likely because shoppers are looking for products they want to buy on BFCM but are not actually purchasing.

- ACoS drops from an average of 25% in North America right before BFCM to 17% over the weekend. There’s a short lift back up to the 25% range before it drops again below 20% for the next several weeks.

- ACoS lifts back up to a level higher than before the holidays in January with the week between Christmas and New Year having the worst performance. Don’t be shocked when your account shows worse performance right after Christmas.

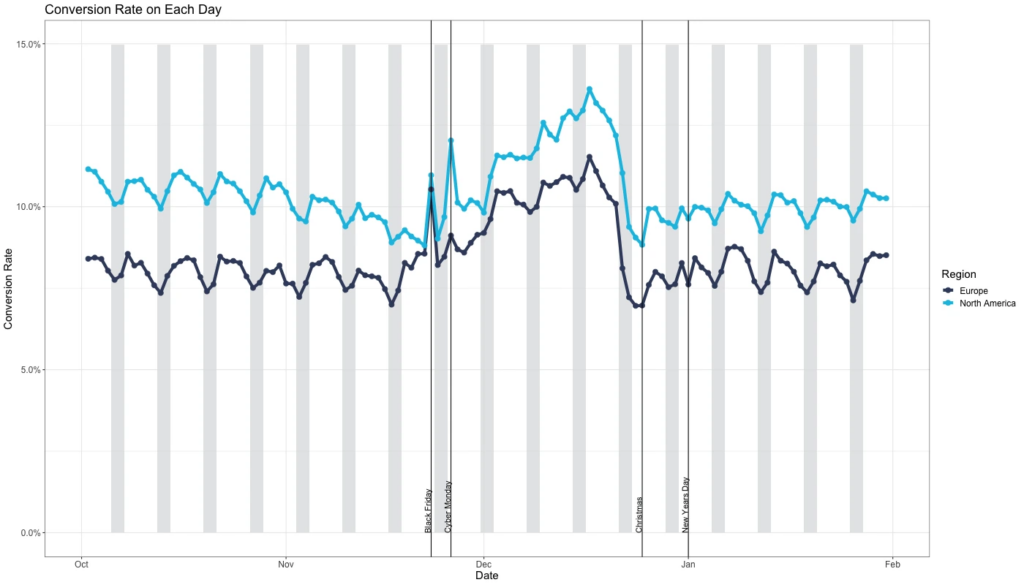

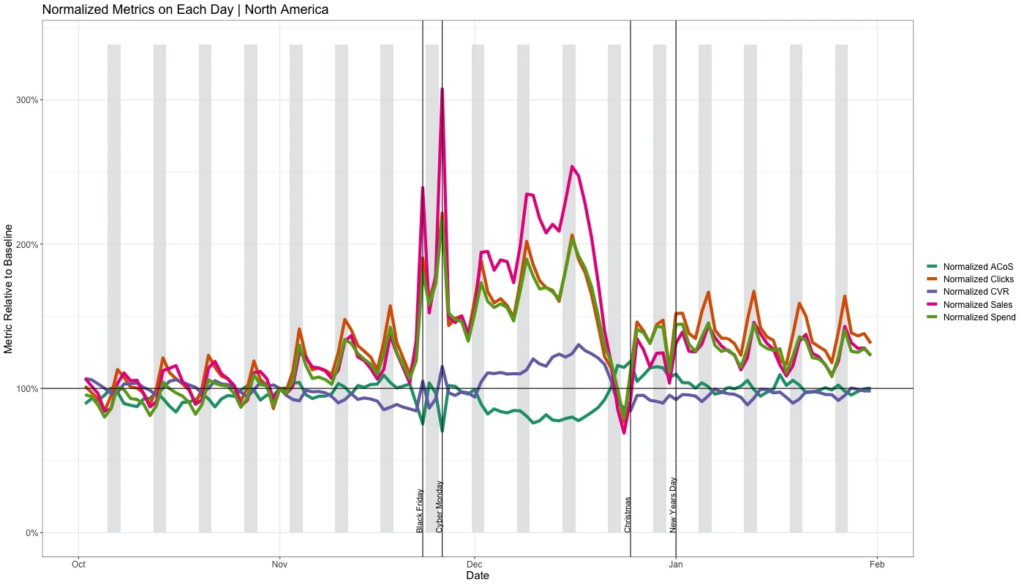

- We can see why ACoS rose right before BFCM: Conversion Rate dropped from ~11% to ~9%.

- It begins to rise quickly, hitting a high of ~13% a week before Christmas.

- If you have a product that is complementary to a frequently gifted product, you may excel during this period right after everyone opens their gifts. If that doesn’t describe your product, consider lowering your bids and budget during this period.

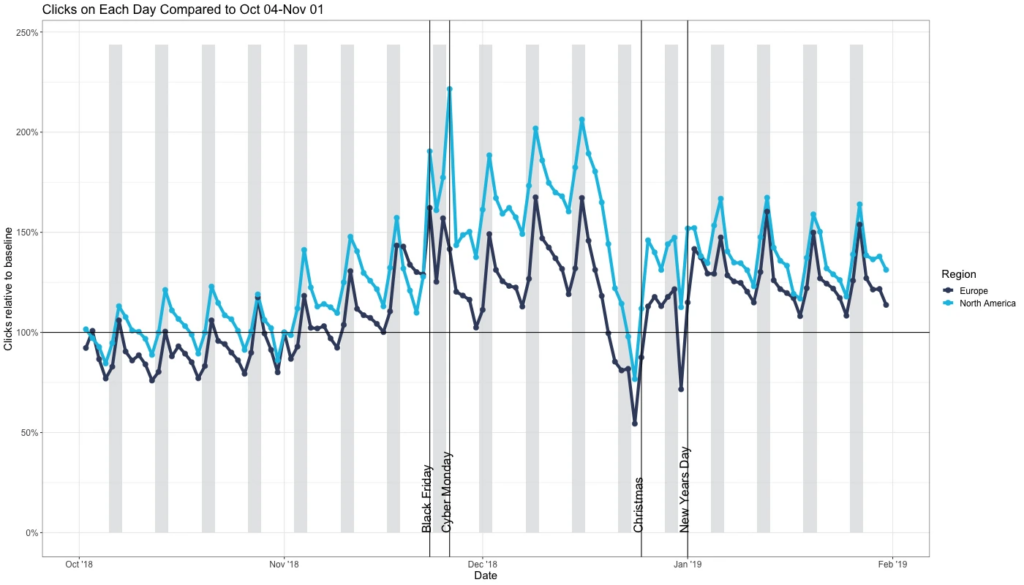

- Click volume begins to rise early November when people start doing their holiday gift research. Don’t be afraid to spend during this phase to get your product on as many gift lists as possible. It will pay off later in November and December.

- Click volume drops after Christmas and bounces back to a higher-than-baseline value in January.

That 25% lift in click volume comes with a 25% lift in spend. Make sure that you’re keeping on top of your budgets if you want to return to your October spend levels. It’s important to realize that the click volume is there if you want it, though. If your January ACoS levels out to a value you’re happy with, we recommend to keep your budgets elevated to continue driving clicks and sales.

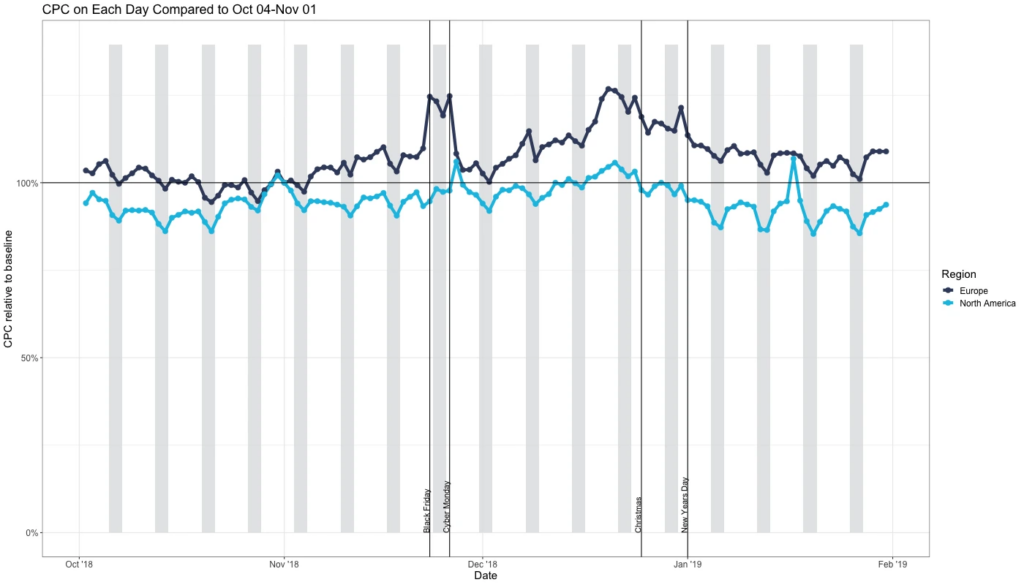

- CPC doesn’t change as much as you’d think during the holiday season. The vast click volume and high conversion rate are the dominating forces during the season.

- CPC is more competitive in Europe than North America. If you’re advertising in European marketplaces, be sure to adjust your bids ahead of BFCM and the week before Christmas.

When we look at them all together on one plot it’s easy to see different phases of the season.

- Volume begins increasing as soon as the calendar turns to November.

- CVR begins decreasing at the same time.

- ACoS has a slight lift right before BFCM and then drops significantly over the weekend.

- ACoS and CVR are inversely correlated, primarily because CPC is flat, as evidenced by clicks and spend tracking right on top of each other.

- Sales show incredible growth.

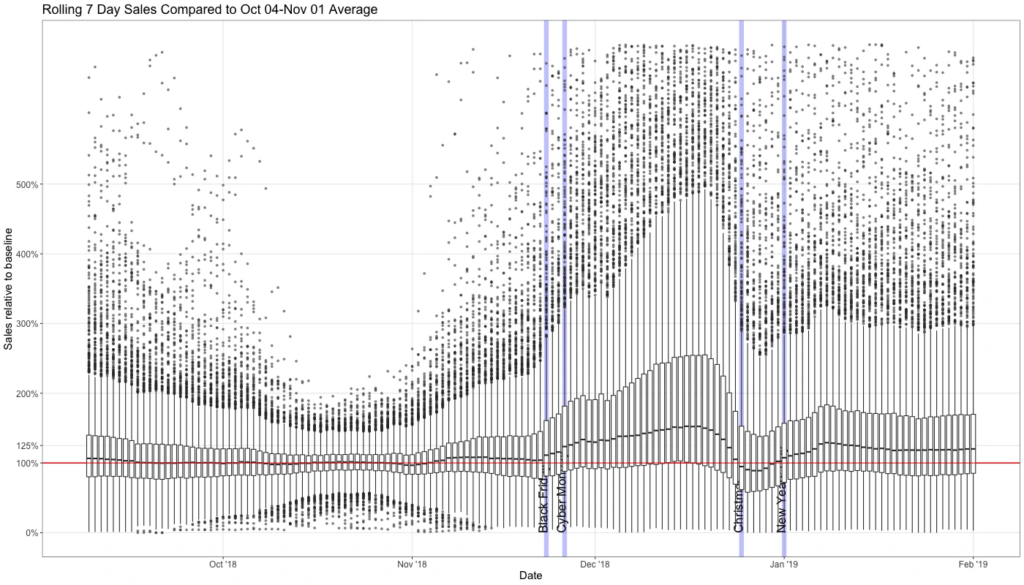

And as a bonus, here’s a more advanced plot (called a box plot) that shows the range of sales shifts.

- The dark black line in the middle is the median value for all accounts on that day

- The box surrounding the black line ranges from the 25th percentile to the 75th percentile

- Whiskers from the box go to +/- 1.5x the range between the 25th and 75th percentiles

- Outliers are shown as dots

What we see here:

- 75% of accounts show greater sales during most of December than their average sales in October

- 25% of accounts show 250% daily ad driven sales during late December compared to the baseline.

- The median account only drops below the October baseline for a few days between Christmas and New years.

- Some accounts show MASSIVE lift. We had to chop the plot off at 700% to make it readable, but some accounts went far higher.

- There’s a lot on the table over the 4 weeks between BFCM and Christmas! Go get it!

Original post from What to Expect During 2019 Holiday Season – Helium 10